Welcome, business owners! Are you looking to take your company to the next level? Look no further than CDFI ERP Software. This powerful tool is designed to unlock the full potential of your business, streamlining operations, increasing efficiency, and driving growth. Say goodbye to manual processes and outdated systems, and say hello to a new era of productivity and profitability. Let CDFI ERP Software be the key to your success!

Understanding CDFI ERP

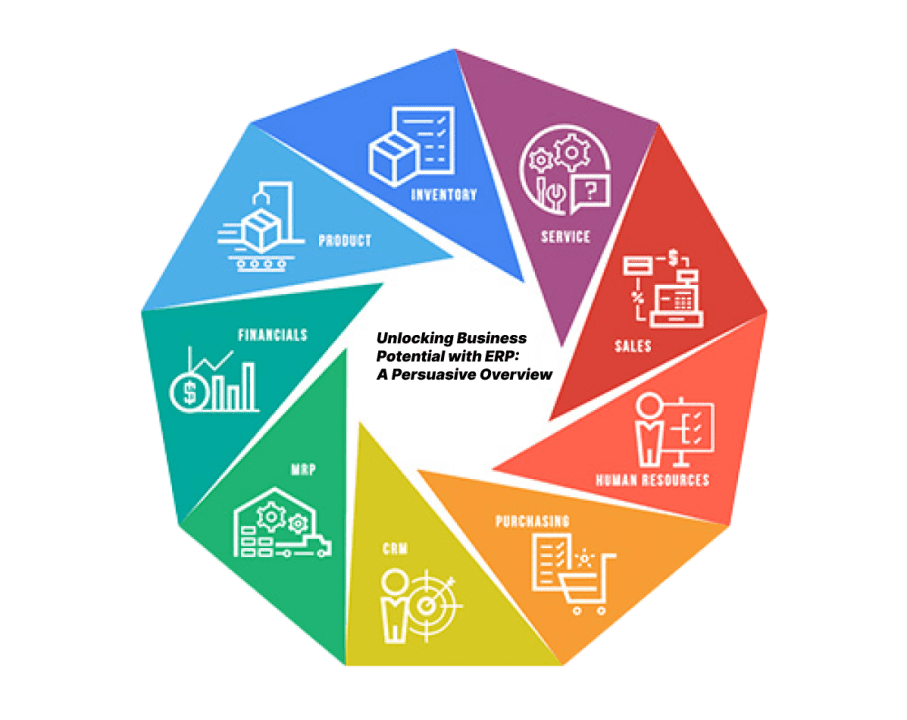

CDFI ERP, or Community Development Financial Institution Enterprise Resource Planning, is a software solution specifically designed to meet the unique needs of CDFIs. This technology helps CDFIs streamline and automate their operations, improve data management, and increase efficiency. ERP systems integrate various functions such as finance, human resources, grants management, reporting, and compliance into a single platform, allowing CDFIs to manage their resources more effectively.

One of the key features of CDFI ERP is its ability to centralize data from different departments within the organization. Instead of using multiple standalone systems that don’t communicate with each other, CDFIs can benefit from having all their data in one place. This not only reduces the risk of errors and duplication but also makes it easier for staff to access the information they need in real-time.

Moreover, CDFI ERP systems come with customizable reporting and analytics tools that allow organizations to track their performance and impact more effectively. By generating detailed reports on financial transactions, program outcomes, and compliance metrics, CDFIs can make informed decisions that drive their mission forward. These reporting capabilities are crucial for demonstrating accountability to funders, stakeholders, and regulatory bodies.

Another advantage of CDFI ERP is its ability to automate routine tasks and workflows, freeing up staff time to focus on more strategic activities. From processing loan applications to managing donor relationships, ERP systems can streamline manual processes and reduce the administrative burden on CDFI employees. This not only boosts productivity but also enhances the overall customer experience, leading to higher satisfaction rates among borrowers, investors, and partners.

Furthermore, CDFI ERP systems are designed to grow with the organization, allowing for scalability and adaptability as the needs of the CDFI change over time. Whether expanding into new markets, launching new financial products, or complying with evolving regulations, ERP solutions can accommodate these changes without disrupting daily operations. This flexibility is essential for CDFIs looking to stay competitive and agile in a rapidly changing environment.

In conclusion, CDFI ERP is a powerful tool that can revolutionize the way Community Development Financial Institutions operate. By centralizing data, improving reporting capabilities, automating tasks, and enabling scalability, ERP systems can help CDFIs streamline their operations, enhance productivity, and achieve their mission more effectively. As CDFIs continue to play a vital role in promoting economic and social development in underserved communities, investing in ERP technology can be a game-changer for their long-term success.

Benefits of implementing CDFI ERP

Implementing a Community Development Financial Institution (CDFI) Enterprise Resource Planning (ERP) system can provide a wide range of benefits for organizations looking to streamline their operations and improve their efficiency. By integrating all of the organization’s key processes and data into a single platform, CDFI ERP helps to enhance decision-making, reduce administrative burdens, and drive sustainable growth. In this article, we will explore the top benefits of implementing CDFI ERP for CDFIs.

One of the key benefits of implementing CDFI ERP is improved operational efficiency. With a centralized system that houses all of the organization’s data and processes, CDFIs can eliminate the need for manual data entry, reduce errors, and improve overall accuracy. This can help CDFIs to streamline their operations, reduce costs, and free up staff time to focus on more strategic tasks. Additionally, with real-time access to up-to-date information, CDFIs can make quicker and more informed decisions, leading to improved performance and outcomes.

Another significant benefit of CDFI ERP is enhanced data security and compliance. As CDFIs deal with sensitive financial information and personal data, it is crucial to have robust security measures in place to protect against data breaches and ensure compliance with regulations such as the Community Reinvestment Act (CRA) and the Bank Secrecy Act (BSA). CDFI ERP systems offer advanced security features such as data encryption, user permissions, and audit trails, helping CDFIs to safeguard their data and maintain compliance with regulatory requirements.

Furthermore, CDFI ERP can help to enhance collaboration and communication within the organization. By providing a central platform for all staff members to access and share information, CDFIs can break down silos between departments, improve interdepartmental communication, and foster a more collaborative work environment. This can lead to increased productivity, better coordination of tasks, and ultimately, improved outcomes for the organization.

In addition to improving operational efficiency, data security, and collaboration, CDFI ERP can also help CDFIs to enhance their reporting and analytics capabilities. By consolidating data from multiple sources into a single platform, CDFIs can generate comprehensive reports, dashboards, and analytics to gain insights into their operations, track performance metrics, and make data-driven decisions. This can enable CDFIs to identify trends, opportunities, and challenges, and adjust their strategies accordingly to drive sustainable growth and impact.

Overall, implementing CDFI ERP can provide a wide range of benefits for CDFIs, including improved operational efficiency, enhanced data security and compliance, enhanced collaboration and communication, and enhanced reporting and analytics capabilities. By investing in a CDFI ERP system, organizations can streamline their operations, improve decision-making, and drive sustainable growth to better serve their communities and fulfill their mission.

Key features of CDFI ERP systems

CDFI ERP systems offer a variety of key features that make them essential tools for community development financial institutions. These systems are designed to streamline and automate a wide range of processes, from financial management to reporting and compliance. Here are some of the key features you can expect to find in a CDFI ERP system:

1. Financial Management: One of the primary features of a CDFI ERP system is its robust financial management capabilities. These systems can handle everything from basic accounting tasks, such as accounts payable and receivable, to more complex functions like budgeting, forecasting, and financial reporting. With a CDFI ERP system, organizations can easily track their financials, generate accurate reports, and make informed decisions based on real-time data.

2. Compliance and Regulatory Reporting: Another important feature of CDFI ERP systems is their ability to help organizations stay compliant with regulatory requirements. These systems are equipped with tools that can automate compliance tasks, such as tracking regulatory changes, generating compliance reports, and managing audits. By using a CDFI ERP system, organizations can ensure that they are meeting all necessary regulatory standards and avoid potential penalties or fines.

3. Customization and Flexibility: One of the standout features of CDFI ERP systems is their customization and flexibility. These systems can be tailored to meet the specific needs of each organization, allowing them to add or remove modules as needed, customize reports and dashboards, and integrate with other software applications. This level of customization ensures that organizations can get the most out of their ERP system and adapt it to their unique requirements.

4. Grant and Fund Management: Many CDFIs rely on grants and funding to support their operations, making grant and fund management a crucial feature of ERP systems designed for these organizations. CDFI ERP systems can track grant applications, manage funding sources, and monitor grant compliance to ensure that organizations are using their resources efficiently and effectively. This feature helps CDFIs maximize their impact and demonstrate accountability to their funders and stakeholders.

5. Collaboration and Communication: Effective communication and collaboration are key to the success of any organization, and CDFI ERP systems are equipped with features that facilitate both. These systems enable teams to work together seamlessly, sharing information, documents, and updates in real-time. They also offer tools for project management, task delegation, and communication, helping organizations stay organized and efficient in their day-to-day operations.

In conclusion, CDFI ERP systems offer a wide range of key features that can significantly benefit community development financial institutions. From financial management to compliance and customization, these systems are designed to streamline processes, improve efficiency, and support the mission of CDFIs. By investing in a CDFI ERP system, organizations can better manage their resources, enhance their operations, and ultimately make a greater impact on the communities they serve.

Choosing the right CDFI ERP solution

When it comes to choosing the right CDFI ERP solution for your organization, there are several factors that need to be taken into consideration. One of the most important things to consider is the size and complexity of your organization. Larger organizations with more complex operations may require a more robust ERP solution with additional features and customization options. On the other hand, smaller organizations may be able to get by with a more streamlined ERP solution that is easier to implement and maintain.

Another important factor to consider when choosing a CDFI ERP solution is your budget. ERP systems can vary widely in cost, so it’s important to have a clear understanding of how much you are willing to spend before you start your search. Keep in mind that the initial cost of the ERP system is just one part of the total cost of ownership – you will also need to consider costs associated with implementation, training, and ongoing support.

It’s also important to consider the specific needs of your organization when choosing a CDFI ERP solution. Different ERP systems offer different features and functionality, so it’s important to choose a solution that aligns with the goals and objectives of your organization. For example, if your organization has a lot of grant funding, you may want to choose an ERP solution that has strong grant management capabilities. If your organization operates in multiple locations, you may want to choose an ERP solution that has robust multi-site functionality.

When evaluating CDFI ERP solutions, it’s also important to consider the level of support and training that is offered by the ERP vendor. Implementing an ERP system can be a complex and time-consuming process, so it’s important to choose a vendor that offers comprehensive training and support to help your organization through the implementation process. It’s also a good idea to choose a vendor that has a strong track record of working with organizations in the CDFI sector, as they will have a better understanding of the unique challenges and opportunities that CDFIs face.

Best practices for CDFIs using ERP systems

Implementing an Enterprise Resource Planning (ERP) system can greatly enhance the efficiency and effectiveness of Community Development Financial Institutions (CDFIs). However, to fully benefit from an ERP system, CDFIs should follow these best practices:

1. Conduct a thorough needs assessment: Before selecting an ERP system, CDFIs should conduct a comprehensive needs assessment to identify their specific requirements and goals. This will ensure that the chosen ERP system meets the organization’s unique needs and aligns with its strategic objectives.

2. Provide comprehensive training: It is essential to provide comprehensive training to staff members on how to use the ERP system effectively. This will help maximize user adoption and ensure that employees are able to leverage the full capabilities of the system.

3. Customize the system to fit your needs: While off-the-shelf ERP systems offer a wide range of functionalities, CDFIs should customize the system to fit their specific requirements. This may involve tailoring workflows, reports, and dashboards to align with the organization’s processes and priorities.

4. Ensure data accuracy and integrity: Maintaining accurate and reliable data is crucial for the success of an ERP system. CDFIs should establish data governance policies and procedures to ensure data accuracy, consistency, and integrity. Regular data audits and quality checks should also be conducted to identify and resolve any discrepancies.

5. Foster a culture of continuous improvement: One of the key best practices for CDFIs using ERP systems is to foster a culture of continuous improvement. This involves regularly reviewing and optimizing processes, identifying areas for enhancement, and leveraging the insights provided by the ERP system to drive strategic decision-making. By continuously seeking ways to improve and innovate, CDFIs can maximize the value of their ERP system and stay ahead of the curve in a rapidly evolving environment.

Originally posted 2025-02-06 20:00:00.