Welcome, fellow business owners and entrepreneurs! Today, we’re diving into the world of finance and technology to explore the key differences between accounting software and ERP systems. Whether you’re a small startup or a well-established company, understanding the nuances of these systems can greatly impact your business operations and overall success. So grab a cup of coffee and let’s explore the exciting world of accounting technology together!

Understanding the Differences

When it comes to discussing accounting software versus ERP systems, it is important to understand the fundamental differences between the two. Accounting software is a tool designed to manage financial transactions efficiently. It typically includes features such as accounts payable, accounts receivable, general ledger, payroll processing, and financial reporting. This type of software is ideal for small to medium-sized businesses that need to streamline their financial processes.

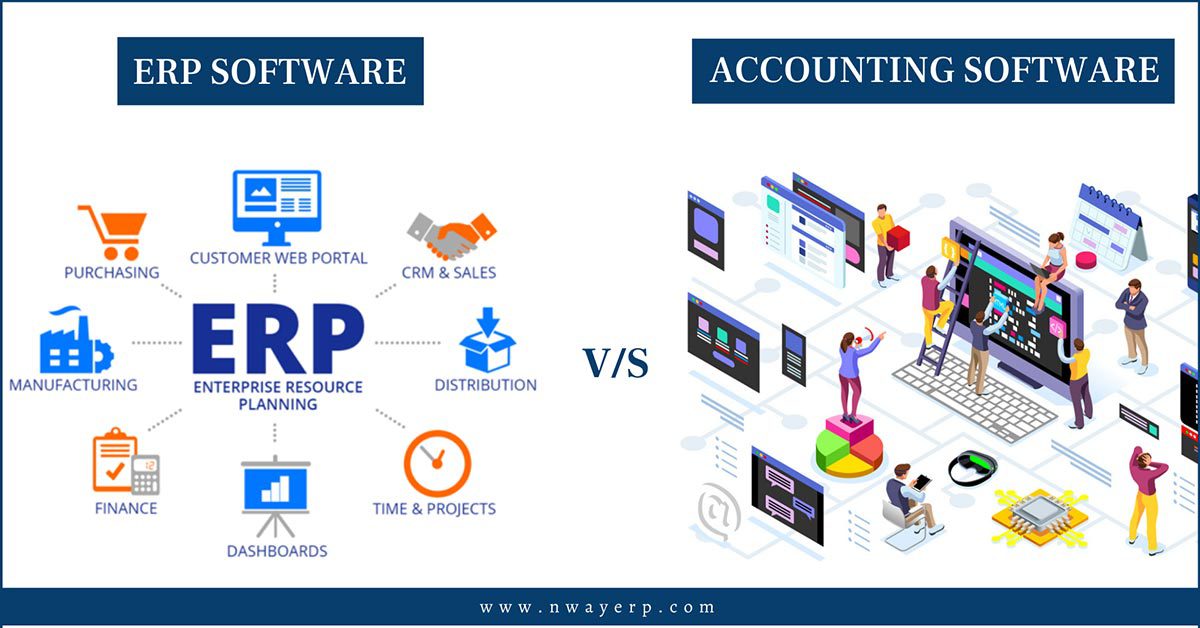

On the other hand, an ERP system is a complete business management solution that integrates various functions and departments within an organization. In addition to accounting modules, an ERP system typically includes modules for inventory management, human resources, customer relationship management, supply chain management, and more. This comprehensive software solution is designed to improve overall efficiency and productivity by providing a unified platform for all business operations.

One of the key differences between accounting software and ERP systems is the scope of functionality. While accounting software focuses primarily on financial transactions, an ERP system offers a broader range of capabilities that extend beyond just accounting. This means that businesses using an ERP system can benefit from a more holistic and integrated approach to managing their operations.

Another important distinction between the two is the level of scalability. Accounting software is typically limited in terms of scalability, and may not be able to support a growing business with increasing transaction volumes and complexities. On the other hand, an ERP system is designed to scale with the growth of a business, making it a more sustainable solution for long-term business management.

Furthermore, accounting software is often considered to be more user-friendly and easier to implement compared to ERP systems. This is because accounting software is designed with a specific focus on financial transactions, whereas an ERP system requires more extensive customization and training to fully leverage its capabilities. While accounting software can be quickly implemented and integrated into existing business processes, an ERP system may require more time and resources to set up effectively.

In summary, the main differences between accounting software and ERP systems lie in their scope of functionality, scalability, and ease of use. While accounting software is ideal for managing financial transactions in a straightforward manner, an ERP system offers a comprehensive solution for integrating various business functions and departments. Ultimately, the choice between accounting software and ERP systems will depend on the specific needs and goals of a business, as well as its capacity for growth and adaptability.

Scope of Features

Accounting software typically focuses on core accounting functions such as bookkeeping, invoicing, and financial reporting. These systems are designed to streamline and automate financial tasks, making it easier for businesses to manage their finances efficiently. Some accounting software may also offer additional features such as budgeting tools, tax preparation, and bank reconciliation. Overall, accounting software is best suited for small to medium-sized businesses looking to improve their financial processes.

On the other hand, ERP (Enterprise Resource Planning) software offers a broader range of features that extend beyond core accounting functions. In addition to accounting capabilities, ERP systems often include modules for inventory management, supply chain management, human resources, and customer relationship management. This comprehensive approach allows businesses to integrate all aspects of their operations into a single system, providing a unified view of their business processes.

ERP systems are typically more robust and complex than accounting software, making them better suited for larger organizations with more complex operations. These systems are designed to scale with the business as it grows, offering greater flexibility and a higher level of customization. While accounting software may be sufficient for basic financial management, ERP software provides a more holistic solution for businesses looking to optimize their operations and improve overall efficiency.

In summary, accounting software is focused on financial tasks, while ERP software offers a more comprehensive set of features that extend beyond accounting to other areas of the business. The choice between the two ultimately depends on the size and complexity of the organization, as well as its specific needs and goals.

Integration and Connectivity

When it comes to choosing between accounting software and ERP systems, one of the key factors to consider is the level of integration and connectivity they offer. Accounting software typically focuses on managing financial transactions and generating reports, whereas ERP systems are designed to integrate and automate core business processes across departments.

Accounting software often operates as a standalone application, making it less integrated with other systems within an organization. This can result in duplicate data entry, errors, and inefficiencies as information needs to be manually transferred between different software applications. On the other hand, ERP systems are built to connect various functions like finance, HR, sales, and operations, providing a central database that streamlines communication and data sharing.

Additionally, ERP systems typically offer more advanced connectivity features, such as real-time data access and collaboration tools. With accounting software, data might need to be exported and imported manually between different systems, leading to delays and potential data inaccuracies. ERP systems, on the other hand, can provide a unified platform where employees can access up-to-date information and collaborate on projects in real-time.

Integration and connectivity are crucial for businesses looking to improve efficiency, reduce errors, and make more informed decisions. An ERP system that offers seamless integration between different departments and functions can help streamline processes, improve communication, and provide a holistic view of the organization’s operations. Accounting software, while useful for specific financial tasks, may fall short in providing the level of integration and connectivity needed for businesses to thrive in a competitive market.

Flexibility and Customization

When comparing accounting software and ERP systems, one key aspect to consider is the level of flexibility and customization they offer. Accounting software typically provides basic functionalities for managing financial data, such as creating invoices, tracking expenses, and generating reports. While these features are essential for managing a company’s finances, they may not offer the level of customization and flexibility that ERP systems provide.

ERP systems, on the other hand, are designed to integrate all aspects of a company’s operations into a single platform. This means that not only can they handle financial management tasks, but they can also manage inventory, human resources, customer relationship management, and more. The flexibility of ERP systems allows businesses to customize the software to meet their specific needs and workflows.

For example, a company that has unique inventory management requirements can customize their ERP system to track multiple warehouses, manage different types of inventory, and automate reorder processes. This level of customization is not typically available in standard accounting software, which may have limited features and options for inventory management.

Furthermore, ERP systems can be integrated with other software applications, such as CRM systems or e-commerce platforms, to create a seamless workflow that streamlines business processes. This level of integration allows data to be shared across different departments, reducing errors and improving overall efficiency.

In terms of flexibility, ERP systems also offer scalability, meaning that they can grow with a company as it expands. This scalability is essential for businesses that are looking to increase their operations and need a software solution that can accommodate their growing needs. Accounting software may not have the same level of scalability, potentially leading to the need for a system upgrade or migration in the future.

In summary, while accounting software is suitable for managing basic financial tasks, ERP systems offer a higher level of flexibility and customization that can benefit businesses with more complex operations. With the ability to customize workflows, integrate with other software applications, and scale as needed, ERP systems provide a robust solution for companies looking to streamline their operations and improve overall efficiency.

Scalability and Growth

When considering the scalability and growth of your business, it is important to understand how accounting software and ERP systems differ in their capabilities. Accounting software typically focuses on basic financial functions such as invoicing, bookkeeping, and financial reporting. While these systems are crucial for managing the financial aspects of a small to medium-sized business, they may lack the capacity to handle the complex needs of a growing enterprise.

On the other hand, ERP systems are designed to integrate and streamline all aspects of a business, including accounting, human resources, inventory management, customer relationship management, and more. This comprehensive approach allows ERP systems to scale alongside your business as it grows and evolves. As you add new products or services, expand into new markets, or increase your workforce, an ERP system can adapt to meet these changing needs.

Additionally, ERP systems often offer advanced features such as real-time data tracking, automated workflows, and customizable reporting tools. These capabilities can help your business operate more efficiently and make informed decisions based on accurate and up-to-date information. By centralizing all of your business processes in one system, an ERP solution can eliminate the need for multiple, disconnected software programs and reduce the risk of errors or redundancies in your data.

Furthermore, ERP systems can provide a holistic view of your business operations, allowing you to identify opportunities for growth, cost savings, or process improvements. By analyzing data from various departments and functions, you can gain insights into your business performance and make strategic decisions to drive future success. With the ability to generate detailed reports and conduct sophisticated analysis, an ERP system can help you anticipate market trends, respond to customer demands, and stay ahead of the competition.

As your business expands and diversifies, an ERP system can support your growth by offering scalable solutions that can accommodate increased transaction volumes, additional users, or more complex business processes. Whether you are opening new locations, entering new markets, or launching new product lines, an ERP system can provide the flexibility and agility you need to adapt to changing circumstances and seize new opportunities.

In conclusion, while accounting software may meet the basic financial needs of a small business, an ERP system offers a more comprehensive and scalable solution for businesses looking to grow and succeed in a competitive marketplace. By investing in an ERP system that can support your long-term growth strategy, you can position your business for success and unlock new possibilities for innovation and profitability.

Originally posted 2025-02-06 03:00:00.